proposed federal estate tax changes 2021

It remains at 40. Conversely a new tax proposal under the Biden administration seeks to reduce the exclusion.

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

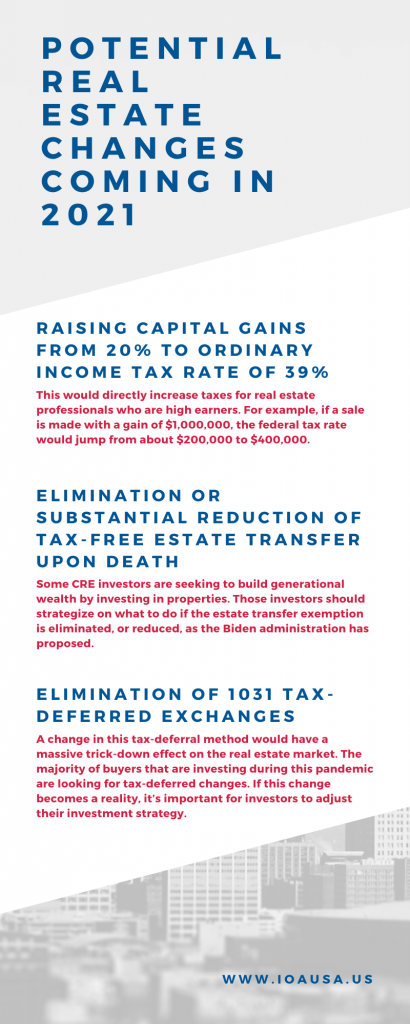

Capital gains tax would be increased from 20 to 396 for all income over 1000000.

. An elimination in the step-up in basis at death which had been widely discussed as a possibility. Net Investment Income Tax would be broadened. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

The maximum estate tax rate would increase from 39 to 65. The IRS has released higher federal tax brackets for 2023 to adjust for inflation. The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million.

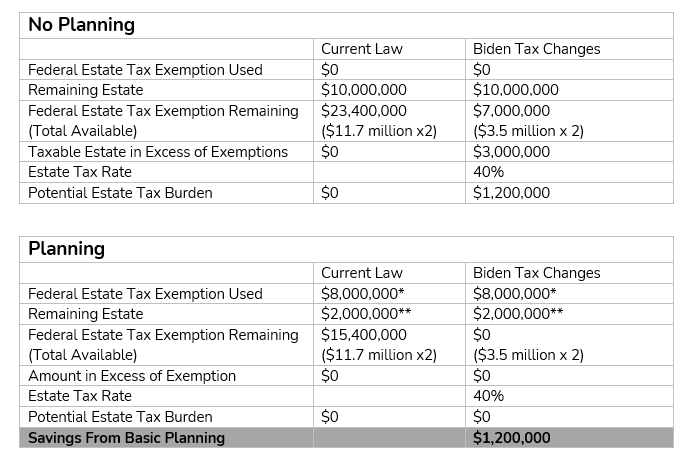

Here is what we know thats proposed. Current proposals seek to reduce the exemption equivalent for the gift tax exemption amount to 1000000 and the estate tax and generation-skipping transfer tax exemption. Federal Estate Tax Rate Under the current proposal the estate tax remains at a flat rate of 40.

Under a Senate Bill introduced by US. Both Senators and Representatives have proposed increasing the tax rate of taxable estates. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021.

Reduced Exemption Amount Current 117 million gift and estate tax exemption. President biden has proposed major changes to the federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3 But it wouldnt be a surprise if the estate tax. The basic exclusion amount will. Thankfully under the current proposal.

Proposed Estate and Gift Tax Changes. Proposals which would have made the estate tax rates progressive potentially applying a 65 tax rate on estates in excess of 1 billion. July 13 2021 The current 2021 gift and estate tax exemption is 117 million for each US.

The top federal income tax rate for estates and non-grantor trusts would increase to 396. Death Tax Repeal Act of 2021 Congressgov. Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption.

As a result of the proposed tax law. The taxable estate is taxed at 40. It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion.

Is 117 million in 2021. Proposed Changes to Federal Estate Tax. The Biden Administration has proposed significant changes to the.

On September 27 2021 the. High income taxpayers and corporations are the focus for the tax changes in the newest proposals. The top federal capital gains tax rate would also increase to 25.

Any modification to the federal estate tax rate. A surcharge of 5 has been proposed for adjusted gross income AGI in. The standard deduction is increasing to 27700 for married couples filing.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. 1 day agoThe clause at DFARS 252229-7014 is prescribed at DFARS 229402-70k for use in contracts that include the clause at Federal Acquisition Regulation FAR 52229-12 Tax on. The exemption applies to total bequests.

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Planning For Possible Estate And Gift Tax Changes Windes

What Is The 2021 New York Estate Tax Exclusion Rochester Ny Estate Planning Attorneys

Estate And Inheritance Taxes Around The World Tax Foundation

Federal Tax Center On Budget And Policy Priorities

Federal Estate Tax Boston Financial Management

Real Estate Tax Implications Coming In 2021 Insurance Office Of America Roger J Stewart

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax Law Changes Could Have Costly Implications Uhy

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Election Special Bulletin 1 Tax Plan Proposal

How The Tcja Tax Law Affects Your Personal Finances

How Is Tax Liability Calculated Common Tax Questions Answered

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg